Filing annual returns is an essential legal requirement for businesses in many countries, including Nigeria. Knowing how to file a business name annual returns helps businesses stay compliant with the law and maintain good standing with regulatory bodies. This guide provides a step-by-step explanation of the process, the importance of filing annual returns, and the consequences of non-compliance.

What is a Business Name Annual Return?

A business name annual return is a mandatory filing that provides regulatory authorities with updated information about a registered business. It typically includes details about the business name, owners, principal office, and any changes that may have occurred since the last return. This filing is required to be submitted annually to the Corporate Affairs Commission (CAC) in Nigeria or equivalent bodies in other countries.

Filing this return ensures that a business remains active in the official register and legally recognized.

Importance of Filing Business Name Annual Return

Before diving into how to file a business name annual return, it’s important to understand why it is necessary:

– Legal Compliance: Filing an annual return is a legal requirement for registered businesses. Failing to file can result in penalties or even deregistration.

– Updated Information: It allows businesses to update their records with the Corporate Affairs Commission (CAC), ensuring accurate representation.

– Maintain Good Standing: Filing regularly keeps a business in good standing with regulatory bodies, which is crucial for securing loans, grants, and contracts.

– Avoid Penalties: Missing deadlines or failing to file may result in fines, which can accumulate over time, becoming a financial burden on the business.

Step-by-Step Guide on How to File Business Name Annual Return

Understanding how to file a business name annual return is crucial for any business owner. Here’s a detailed guide to the process in Nigeria:

Step 1: Confirm Eligibility to File

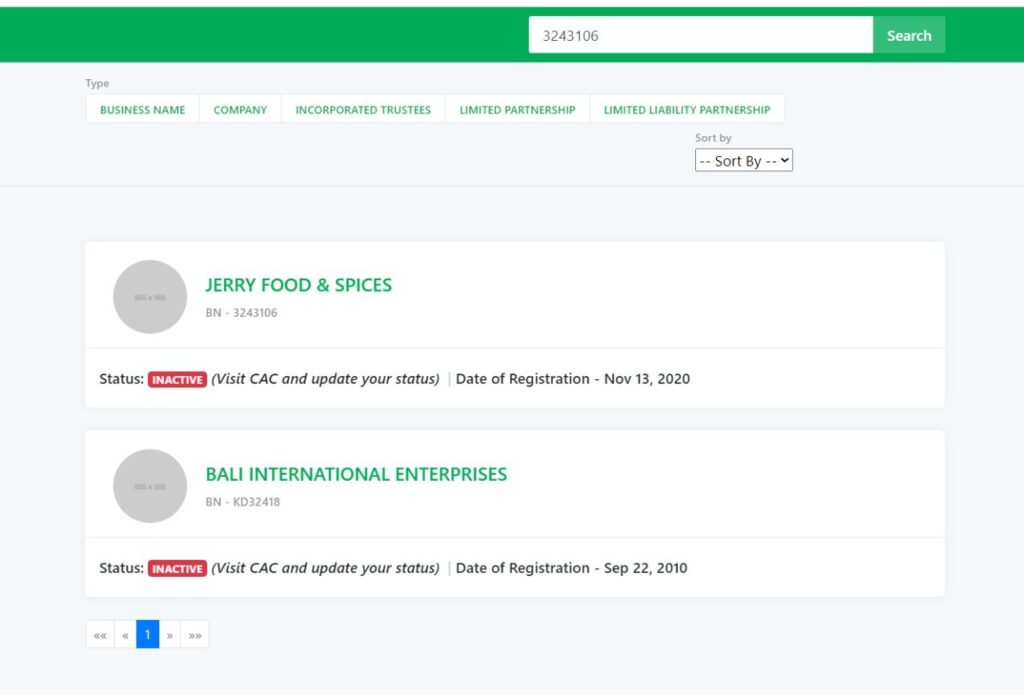

Before proceeding with the filing, ensure your business name is still active and has not been deregistered. Businesses that have been dormant or struck off the register may need to take extra steps to reactivate their status before filing annual returns.

To check the status of your business, you can log on to the [Corporate Affairs Commission (CAC) portal](https://www.cac.gov.ng/).

Step 2: Prepare the Necessary Documents

To file your business name annual return, you will need the following documents:

– The original certificate of registration

– A completed annual return form (CAC BN-7 form).

– Current information about your business, including any changes in the ownership, address, or operations.

Ensure all documents are up to date and accurate before submitting them.

Step 3: Log Into the CAC Portal

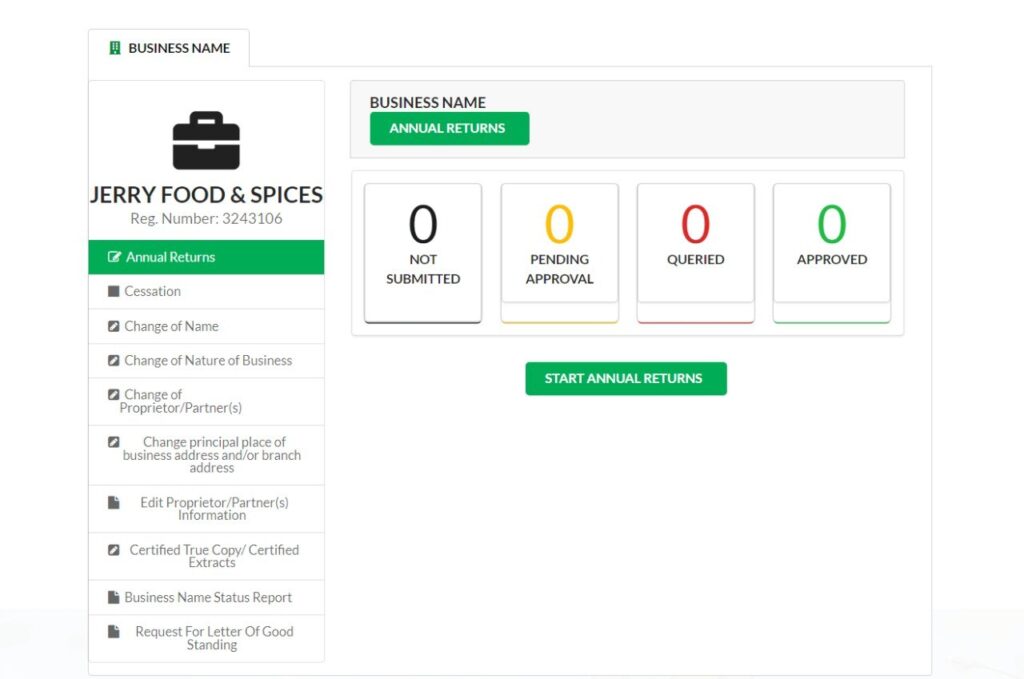

The next step in how to file a business name annual return is to log in to the Corporate Affairs Commission (CAC) portal using your credentials. If you don’t already have an account, you will need to create one using a valid email address and phone number.

Once logged in, navigate to the section for filing annual returns.

Step 4: Fill Out the Annual Return Form

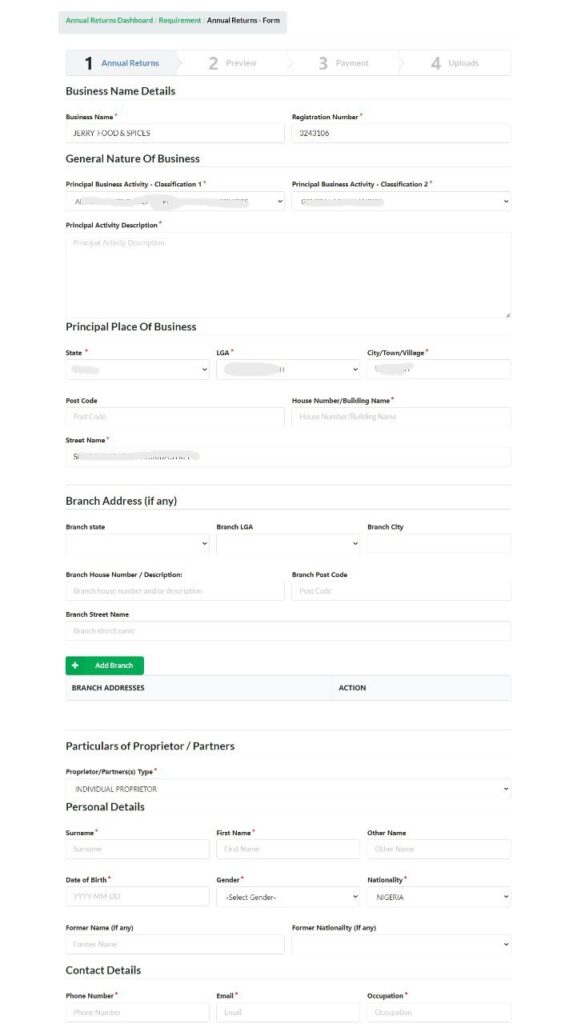

On the CAC portal, you will find the annual return form (CAC BN-7 form). You must fill in the required fields, including:

– Business name.

– Registration number.

– Date of registration.

– Principal place of business.

– Nature of the business.

– Details of business owners.

Make sure that all the information provided matches the original registration documents.

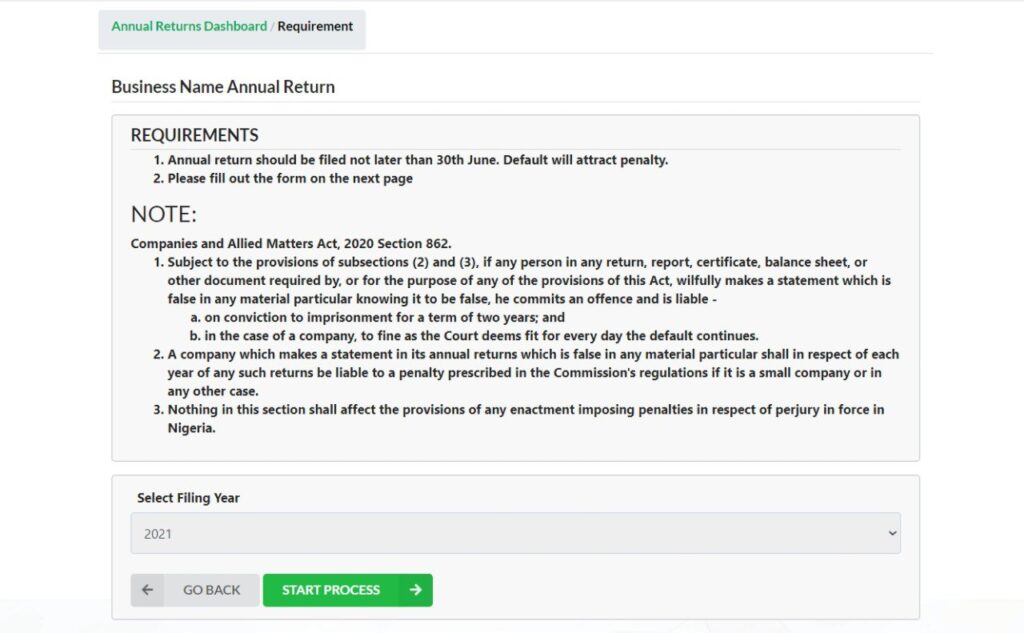

Step 5: Pay the Filing Fee

After completing the form, you will be prompted to pay the required annual return fee. The fee is relatively low and depends on the type of business and how long it has been registered. Payment can be made directly through the CAC portal using a debit card or other online payment methods.

Ensure that you keep the receipt of your payment for future reference.

Step 6: Submit the Annual Return Form

Once payment is confirmed, you can submit your annual return form online. If all the information provided is correct and complete, the submission process will be successful. After submission, the CAC will review your return and, if approved, update your business status on their database.

Step 7: Obtain Proof of Filing

After your submission has been approved, you will receive confirmation from the CAC. Keep this confirmation as proof of filing. You can also check your business status on the CAC portal to ensure your annual return has been processed.

Consequences of Failing to File Business Name Annual Return

Understanding how to file a business name annual return is critical to avoid the legal and financial repercussions of non-compliance. Businesses that fail to file their annual returns face the following consequences:

– Fines and Penalties: The CAC imposes fines on businesses that miss the filing deadline, and the longer the delay, the higher the penalties.

– Deregistration: Persistent failure to file can lead to the deregistration of the business, which effectively means the business no longer exists in the eyes of the law.

– Loss of Opportunities: Businesses not in good standing with regulatory bodies may face difficulties securing contracts, government grants, or bank loans.

1. When is the deadline to file the annual return?

Businesses are required to file their annual return every year, starting one year after the business name registration anniversary. It’s important to file within the prescribed time to avoid penalties.

2. How much does it cost to file a business name annual return?

The filing fee is relatively affordable, but the exact amount depends on the type of business entity. You can check the updated fee schedule

3. What happens if I miss the annual return filing deadline?

If you miss the deadline, you will be required to pay a fine, which increases the longer you delay filing. Continued failure to file may result in the deregistration of your business name.

Conclusion:

Knowing how to file a business name annual return is essential for any business owner in Nigeria. Filing ensures that your business remains compliant with local laws, stays in good standing, and avoids penalties. By following the steps outlined in this guide, you can easily file your business name annual return through the CAC portal and maintain a strong legal status for your business.

For more information on business name registration and annual returns in Nigeria, you can visit the following resources:

Contact: WhatsApp David (Customer Support) 08032371969.

Join our Sub Agent Team for flexible work schedules to increase earning potential.

https://docs.google.com/forms/d/1hO–8IhlCkxiWAK16-Dsq2LgPSTQk3brxDttk9X2bi0/prefill

I do believe all of the ideas you have presented on your post. They’re very convincing and can certainly work. Nonetheless, the posts are very short for starters. May you please prolong them a bit from subsequent time? Thank you for the post.