Filing the annual return for a private limited company is a legal requirement under Nigerian law. Understanding how to file CAC private limited company annual return in Nigeria is essential for companies to maintain compliance, avoid penalties, and keep their business in good standing with the Corporate Affairs Commission (CAC). This guide provides a step-by-step overview of the process, benefits, and key considerations for business owners.

What is an Annual Return for Private Limited Companies?

An annual return is a mandatory filing that provides the CAC with updated information about a company. It includes details like the company’s directors, shareholders, registered address, and share capital. Filing annual returns helps the CAC keep accurate and up-to-date records on all registered companies in Nigeria. Failing to file your annual return on time can lead to penalties and legal issues.

Importance of Filing Annual Return

Before diving into how to file CAC private limited company annual return in Nigeria, it’s important to understand why filing is crucial:

– Legal Compliance: It is required by law to file annual returns every year. Failing to do so can result in penalties and, in extreme cases, lead to the deregistration of the company.

– Avoiding Penalties: Late filing of annual returns can attract significant fines, which increase with time.

– Maintaining Corporate Status: Regular filing ensures that your company remains in good standing and avoids being flagged as inactive by the CAC.

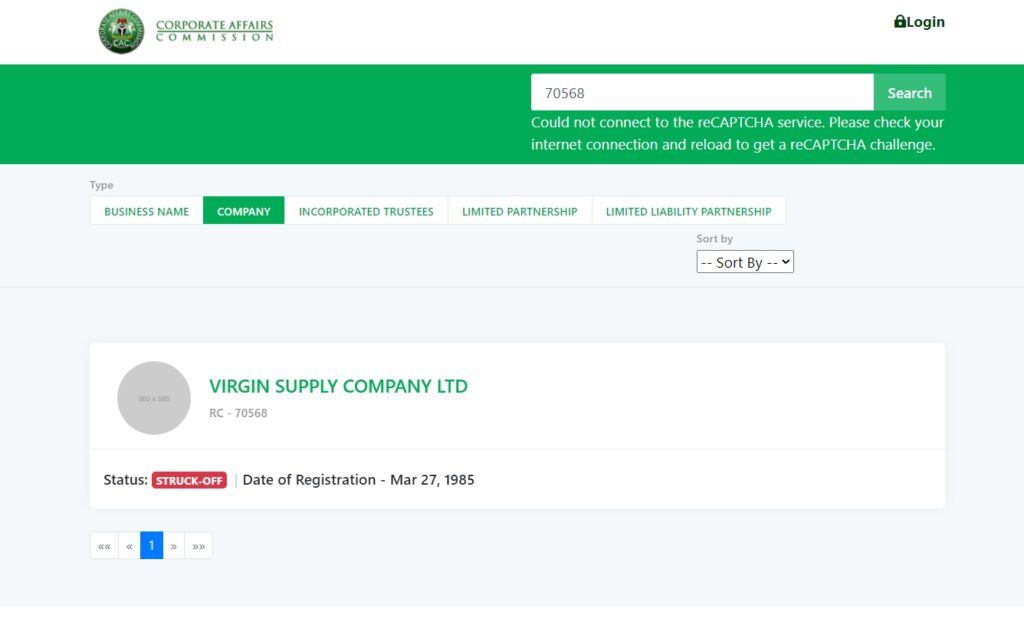

Step 1: Gather Necessary Information

The first step in how to file CAC private limited company annual return in Nigeria is gathering all the necessary information required for filing. This includes:

– Company registration number (RC number).

– The names and details of directors and shareholders.

– Updated financial statements of the company.

– Current registered office address.

– Details of the company’s share capital and paid-up capital.

Having all this information ready ensures that the process is smooth and error-free.

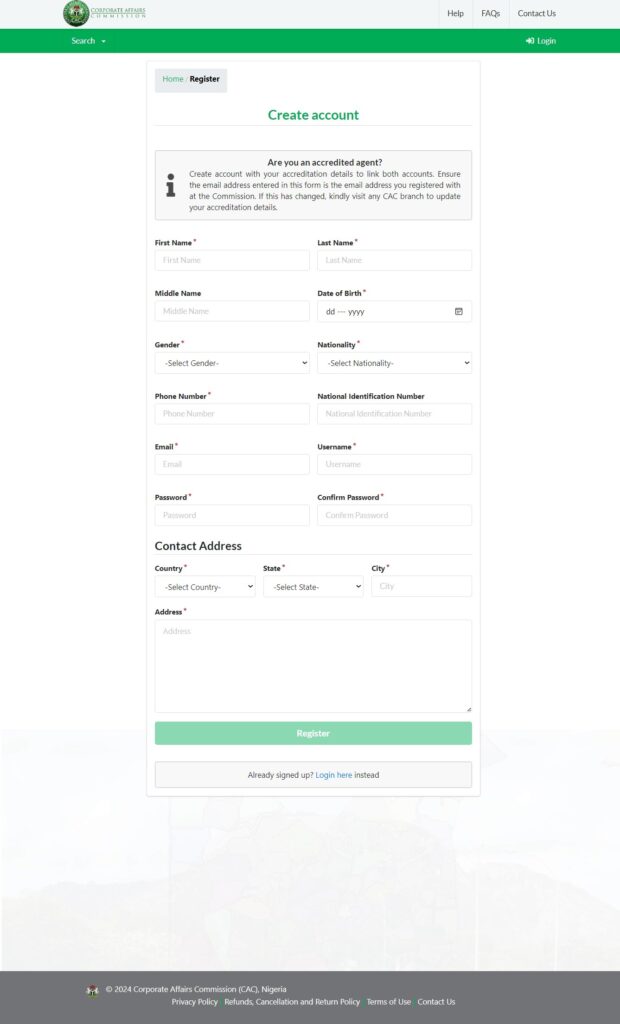

Step 2: Log into the CAC Portal

To file your annual return, you need access to the Corporate Affairs Commission’s (CAC) e-portal. If you don’t have an account, you’ll need to create one using your company’s information. This online platform simplifies the process of filing returns and allows companies to track the status of their filings in real-time.

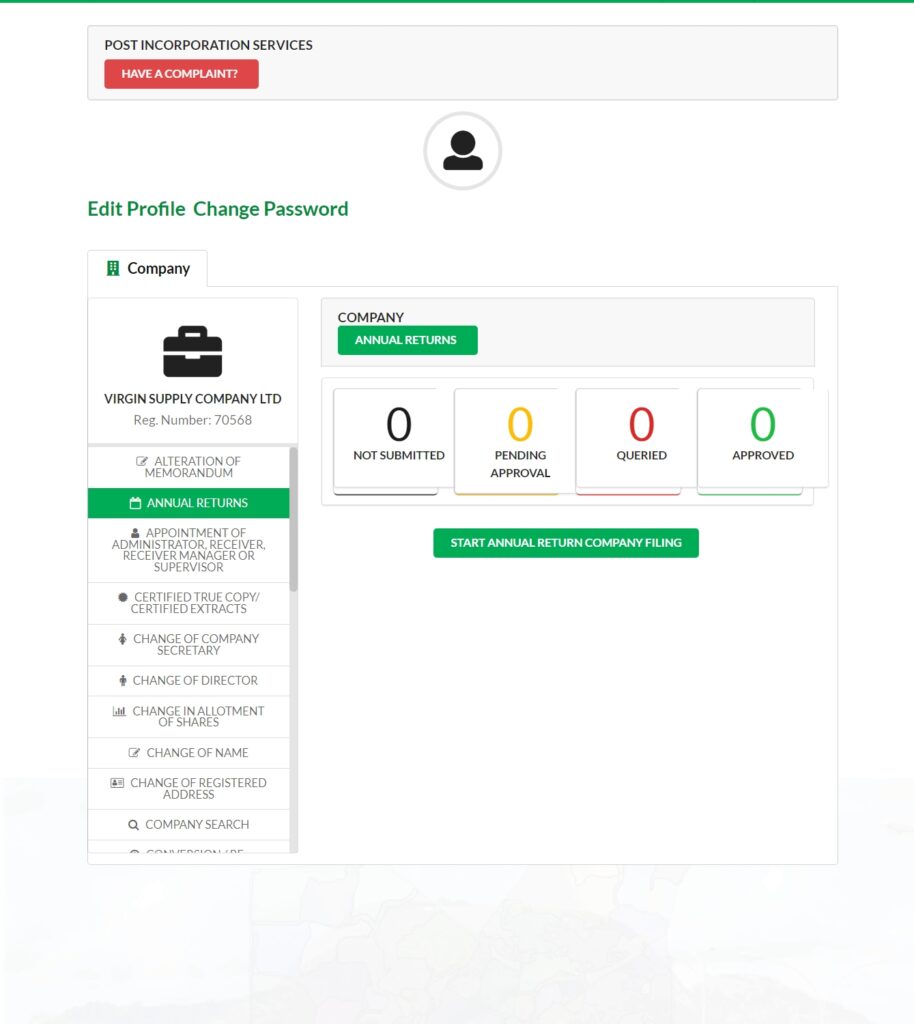

Step 3: Select “File Annual Return”

Once logged in, select the “Annual Return” option from the menu. This section is where you’ll begin filing your company’s return. The portal will guide you through each step of the process. Be sure to double-check that you’re selecting the correct option for private limited companies, as the process can vary for other business structures.

Step 4: Complete the Annual Return Form

The next step in how to file CAC private limited company annual return in Nigeria is completing the return form. You’ll be required to provide the following information:

– Company name and registration number.

– Current financial details, including share capital and any changes made in the previous year.

– Full names, addresses, and occupations of company directors and shareholders.

– Information on any changes in the company’s directors or shareholders.

Ensure that all the information is accurate. Any errors in the form could result in delays or rejections, potentially leading to penalties for late filing.

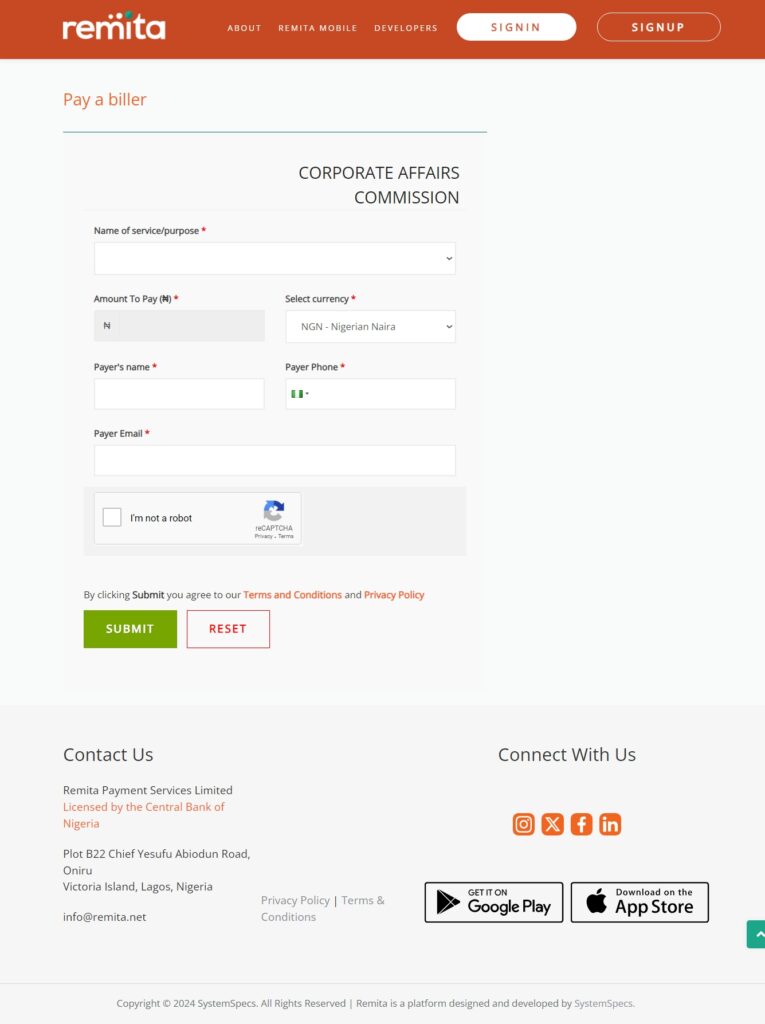

Step 5: Pay the Filing Fee

After completing the annual return form, you will need to pay the required filing fee. The fee for filing an annual return for a private limited company in Nigeria is relatively affordable, though it may vary slightly depending on the age of the company and whether you’re filing for multiple years.

Payment can be made directly through the CAC portal using a debit card or other online payment methods.

Step 6: Submit Your Return and Required Documents

Once payment is made, you’ll need to submit the form and upload supporting documents. These typically include:

– A copy of the company’s financial statements (if applicable).

– A signed declaration of solvency from the company’s directors.

– Updated information on the company’s shareholders and share capital.

After submission, the CAC will review your return. The processing time may vary, but you can track the progress of your filing through the portal.

Step 7: Receive Confirmation

Upon successful submission and approval, the CAC will send a confirmation that your annual return has been filed. Keep this confirmation for your records, as it serves as proof of compliance with the CAC’s filing requirements. You can download and store the confirmation from the CAC portal.

Consequences of Not Filing Your Annual Return

If you fail to file your annual return on time, the CAC will impose late penalties. The fines accumulate over time and can become a financial burden if neglected. Furthermore, repeated failure to file may lead to the deregistration of your company, effectively stopping your business from operating legally.

If you need more information on how to file CAC Private Limited Company annual return in Nigeria or other business-related services, these resources may be helpful:

Tips for a Smooth Filing Process

– File early: Don’t wait until the deadline to file. Filing early reduces the risk of incurring penalties.

– Accurate records: Keep accurate records of your company’s activities throughout the year to avoid discrepancies during filing.

– Use a professional: If you’re unsure of the process, consider hiring a professional to help with the filing.

Conclusion: How to File CAC Private Limited Company Annual Return in Nigeria

Knowing how to file CAC private limited company annual return in Nigeria is vital for maintaining your company’s legal status and avoiding penalties. The process is straightforward if you gather the necessary documents, complete the form accurately, and submit on time through the CAC portal. Regular filing ensures that your company remains compliant with Nigerian law, allowing you to focus on growing your business without worrying about fines or legal issues.

Make sure to file your annual return before the due date to keep your business in good standing with the CAC.

Contact: WhatsApp David (Customer Support) 08032371969

Join our Sub Agent Team for flexible work schedules to increase earning potential.

https://docs.google.com/forms/d/1hO–8IhlCkxiWAK16-Dsq2LgPSTQk3brxDttk9X2bi0/prefill