Filing SCUML (Special Control Unit Against Money Laundering) in Nigeria is a critical process for Designated Non-Financial Institutions (DNFIs) to comply with anti-money laundering regulations. This guide will walk you through how to file SCUML in Nigeria, why it’s important, and how to stay compliant with regulatory requirements.

Meta Description

Learn how to file SCUML in Nigeria with this detailed step-by-step guide. Understand the requirements, process, and benefits of filing SCUML for compliance with anti-money laundering laws.

What is SCUML?

SCUML stands for the Special Control Unit Against Money Laundering, an agency under the Economic and Financial Crimes Commission (EFCC) in Nigeria. It ensures that DNFIs comply with the Money Laundering (Prohibition) Act, which mandates reporting suspicious transactions and maintaining financial transparency.

Why is Filing SCUML Important?

Before diving into how to file SCUML in Nigeria, let’s understand why it’s essential:

1. Legal Compliance: Filing SCUML is mandatory for DNFIs, including real estate agents, jewelers, lawyers, and accountants, to operate legally in Nigeria.

2. Avoidance of Penalties: Non-compliance can lead to penalties, license revocation, or legal action by the EFCC.

3. Access to Banking Services: Banks in Nigeria require SCUML certificates for account opening and transaction purposes.

4. Fighting Money Laundering: Filing SCUML strengthens Nigeria’s fight against money laundering and terrorist financing by promoting transparency.

How to File SCUML in Nigeria: A Step-by-Step Process

Step 1: Determine Eligibility

Before filing, ensure that your business falls under the category of Designated Non-Financial Institutions (DNFIs). These include:

– Real estate businesses

– Hospitality services (hotels, casinos)

– Jewelers and precious stone dealers

– Accountants and auditors

– Legal practitioners handling financial transactions

Step 2: Gather Required Documents

To register and file for SCUML, you’ll need:

– Certificate of Incorporation (CAC)

– Tax Identification Number (TIN)

– Evidence of business ownership (e.g., partnership agreement or deed)

– Identification documents of directors or owners

– Utility bills for address verification

Step 3: Register on the SCUML Portal

Visit the official [SCUML registration portal](https://scuml.org.ng/register). Create an account by entering your business details, uploading the required documents, and confirming your email.

Step 4: Submit the Application

Log in to your account and complete the application form. Ensure all details are accurate and consistent with your CAC and other official records. Submit your application and wait for confirmation.

Step 5: Follow Up with SCUML

Once your application is submitted, SCUML officials may request additional documents or clarification. Monitor your email and the SCUML portal for updates.

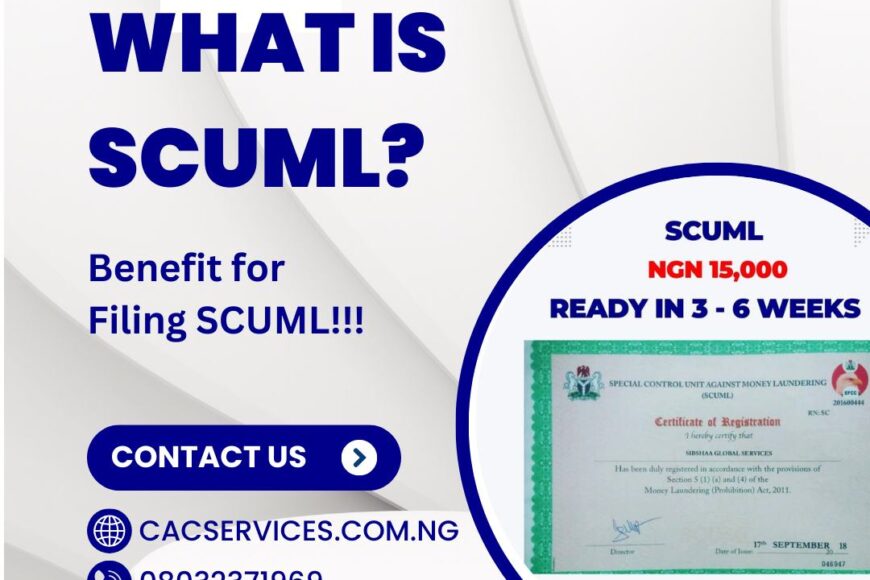

Step 6: Obtain Your SCUML Certificate

If your application is approved, you’ll receive a SCUML certificate. This document is necessary for conducting transactions with banks and ensures your compliance with money laundering regulations.

Having Difficulty following the step to filing DPR kindly contact for ‘HELP’

WhatsApp David (Customer Support) 08032371969.

Common Challenges When Filing SCUML in Nigeria

1. Incomplete Documentation: Ensure all documents are complete and accurate to avoid delays.

2. Portal Glitches: The SCUML portal may experience downtime; remain patient and persistent.

3. Regulatory Updates: Stay informed about changes to SCUML requirements to maintain compliance.

Benefits of Filing SCUML in Nigeria

– Legal Protection: Safeguards your business from regulatory actions.

– Enhanced Reputation: Shows commitment to transparency and ethical practices.

– Ease of Doing Business: Banks and financial institutions will readily work with SCUML-compliant businesses.

Conclusion: Mastering How to File SCUML in Nigeria

Knowing how to file SCUML in Nigeria is essential for DNFIs to operate legally, avoid penalties, and support the nation’s fight against financial crimes. By following the steps outlined above, you can streamline the process and ensure compliance with anti-money laundering laws. Start your SCUML filing today to safeguard your business and contribute to a transparent financial system.

For more information on filing requirements, WhatsApp David(Customer Support) 08032371969 or click on the link to chat him directly.

Join our Sub Agent Team for flexible work schedules to increased earning potential. https://docs.google.com/forms/d/1hO–8IhlCkxiWAK16-Dsq2LgPSTQk3brxDttk9X2bi0/prefill